Imagine you provide transportation services through an app and have an accident that disables your vehicle for a week. We all know that the cost of repairs is recoverable. But what about the income the vehicle stopped generating during that time? That, precisely, is loss of profit.

Loss of profit is simply the income a company failed to receive due to a disruptive event, in other words, what never entered the company because of what happened. From a financial perspective, failing to measure it properly means severely underestimating the real impact of a loss on profitability, since it directly affects the income statement and the company’s market opportunities.

This concept is often viewed through a legal lens, but why is its financial connotation crucial? Because courts and insurers do not accept unsupported claims. It’s not enough to say, “We lost earnings.” It must be proven, with certainty, using financial tools and accounting documentation, that such profits would have been earned had the incident not occurred. This is where the financial analyst’s role becomes critical.

How Do We Quantify Lost Profit? The View of a Financial Expert

Once the causal link has been irrefutably established, that is, once it’s demonstrated that the event was the direct trigger of the income-generating activity’s interruptionthe quantification phase begins. At Silver, we have successfully applied this approach in cases where calculating such losses was crucial. These cases have been resolved using the same hallmark: a rigorous analysis and a structured methodology that guarantees a solid and defensible calculation. Based on our experience in previous cases, the following steps outline the fundamental process for quantifying lost profit in a technical and defensible manner in a case where a project was partially executed but its completion was prevented by an unforeseen event.

In such cases, we analyze the real data from the completed phase, cash flows, operating margins, execution time, etc. to establish a proven performance baseline. This information is then compared with industry standards to validate its reasonableness.

Using the proven profitability baseline from the executed portion, we estimate the annual cash flows that the unfinished portion would have generated from the year of interruption up to the present.

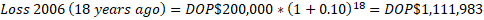

Instead of discounting future cash flows, the value of the lost earnings in each historical year is capitalized. An updating rate (generally based on accumulated historical inflation, financial certificate interest rates, or the average cost of capital) is applied to each lost cash flow from the year it was not received until the present. This gives us the equivalent present value of what was lost.

Let’s illustrate this with numbers highlighting the critical role of the time value of money:

Imagine that in 2004 we built a shopping center, and a soil failure prevented the construction of Phase 2 of the complex. Phase 1 generated, on average, an annual net cash flow of DOP$500,000, and it is estimated that if Phase 2 had been built in 2004, it would have generated DOP$200,000 annually from 2005 to 2024 (20 years).

Simply adding DOP$200,000 year after year from 2005 to 2024 makes no economic sense, as it mixes pesos with different purchasing power due to the time value of money. The correct approach is to calculate the Future Value (FV) of each annual lost gain, capitalizing it up to 2024, using an annual updating rate of 10%.

After performing this operation for all 20 years and summing up the results, the updated lost profit as of 2024 amounts to approximately DOP$11,455,000.

The loss of DOP$200,000 annually starting in 2005 is not equivalent to DOP$4,000,000 in total (DOP$200,000 × 20 years), but rather to DOP$11,455,000 in today’s terms.

The DOP$7,455,000 difference represents the financial cost of deferral, that is, the loss of purchasing power and the opportunity cost of not having had that money available to invest each year since it should have been received. For this reason, compensating only the original nominal amount would cover just a fraction of the real damage.

In summary, lost profit is a powerful concept that protects your company’s future profitability. However, the success of such a claim depends almost entirely on the strength of the financial evidence. Underestimating its calculation may mean leaving a considerable amount of money on the table. At Silver, our team of financial experts specializes in the quantification and documentation of lost profit—helping clients transform an intangible loss into a concrete, defensible, and maximized claim.